CryptoInvesting.art helps new investors add cryptocurrency into their investment portfolio. The crypto world is complex. Knowing where to buy, how much to invest and what has good yields ⸺ becomes a new art.

USD Coin

The world's leading digital dollar stablecoin

This is the most stable of stablecoins, with $46 BILLION with $1.6 TRILLION in transactions a year, under Circle.

Stablecoins are supposedly pegged 1-1 with US dollar. But it was revealed (2021 Aug) that cash made up just 60% of its reserve. The other 40% was backed by various forms of debt securities and bonds.

Then in 2021 Dec, they testified before congress that they are backed by 100% cash and treasury bonds.

They are audited monthly by Grant Thornton LLP.

USDC is safer compared to USDT (aka Tether), which has worse composition and less transparent audits.

Their humanitarian effort in Venezuela is a good sign of cryptocurrency being adopted by consumers.

How Circle make money?

- Interest from USD reserves (that are minted to USDC)

- Circle account & API

- SeedInvest crowdfunding platform

- Circle Yield

Backings

Founded by Coinbase (and Circle).

Received $270 million in venture backing from investors including Accel Partners, Bitmain, Blockchain Capital, Breyer Capital, CICC Alpha, China Everbright Bank, Digital Currency Group, General Catalyst, IDG Capital, and Pantera.

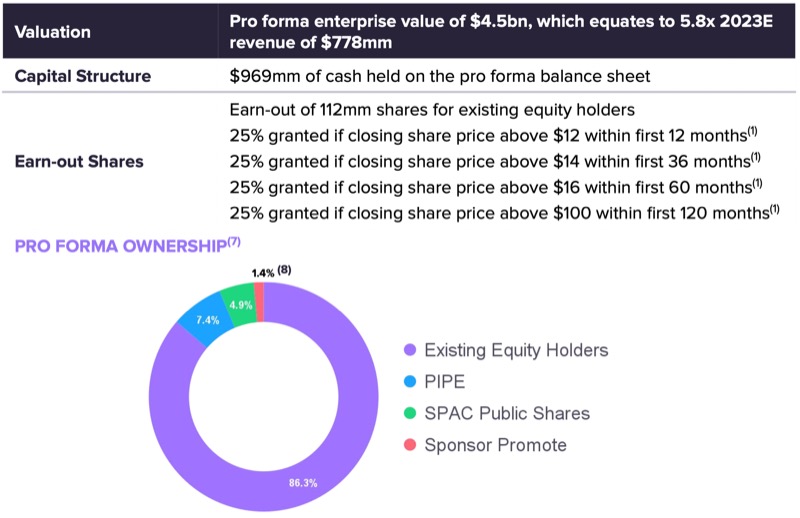

SPAC Listing

In 2021, Circle was acquired by Concord Acquisition Corp, a special purpose acquisition company (SPAC). Post acquisition they will have a market cap of $5.5 billion.

$276M IPO capital + $415M PIPE, with each share at $10.

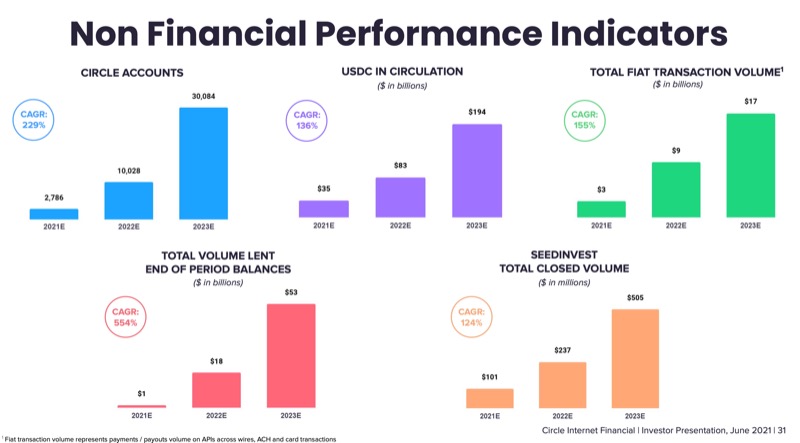

Their forecast of USDC in circulation:

- 2021: $35B

- 2022: $83B

- 2023: $194B

Circle API (Technical stuff)

Their product is payment API. Pricing wise they are same as the industry – credit card transaction will cost 2.9% + $0.30.

- Payment with credit cards

- And even wire

- Payout

- Send to blockchain addresses