How Anchor protocol works?

Anchor protocol has been getting the limelight for the past year as it maintained a 20% deposit interest for it’s stablecoin. But the last few months, it has been getting the heat as their yield reserve is depleting. The high interest might not sustain for long.

Background

Anchor protocol is a core component of Terra ecosystem. Terra is a blockchain, like Ethereum, but with a focus on being the Internet money. To do that, they have their own stablecoin – UST (aka Terra USD). Don’t be confused with USDT (aka Tether), which is a very popular stablecoin.

Another component of Terra is Mirror protocol, which allow you to trade stock market!

What’s more, Terra has a real-world eCommerce use case with 10 million users. They partnered with CHAI, a Korean mobile payment service.

The value proposition

Anchor marketed themselves as “Better Savings”. True in a certain sense because you can 20% interest for depositing their stablecoin! As you know, stablecoin are pegged to fiat, so there is no volatilty like other tokens.

Not not exactly true, because they are not like bank savings account. They come with more risks. Before I discuss the risks, let’s understand how it works next.

Anyway, a better comparison is with other stablecoin staking, such as USDC, which you can easily earn 8-12% on Crypto.com.

How they generate such high interest

Anchor is like a business with Profit & Loss (P&L).

The “profit” comes from:

- Borrower of their UST must pay an interest of ~10%

- Borrower also have to put LUNA or ETH as collateral, which will in turn provide staking rewards

The “loss” comes from:

- Users who deposit UST earns 20%

It’s just that simple. Like a business there are good times and bad times. When the profit > loss, the surplus will be added to a Yield Reserve. When profit < loss, the deficit will be taken from the Yield Reserve.

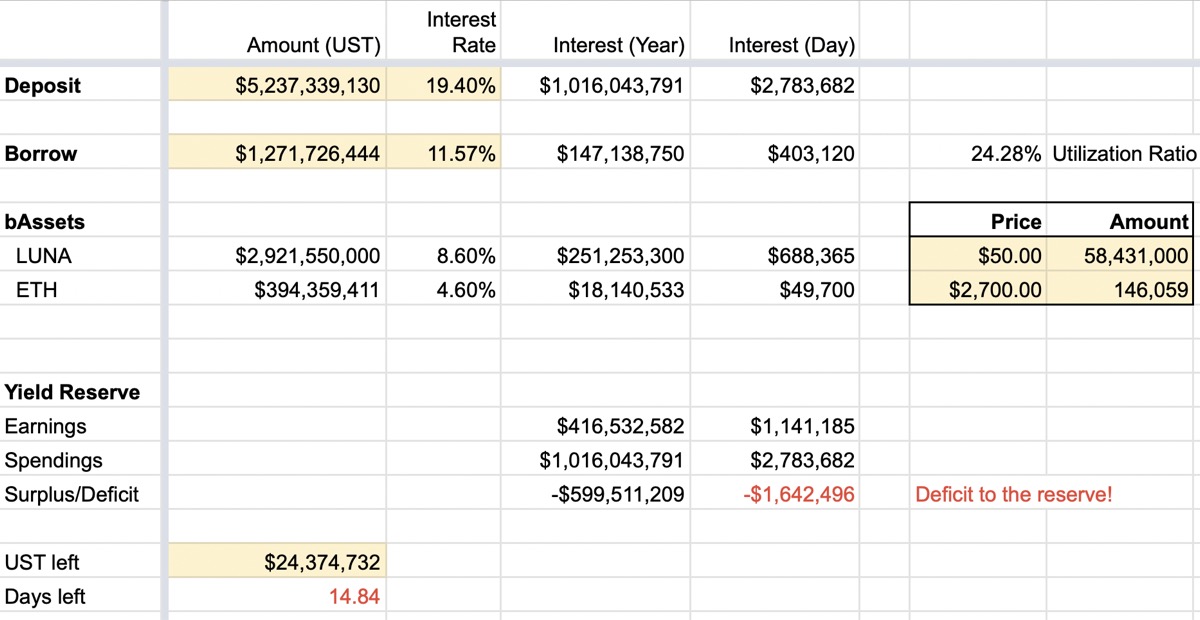

Anchor Spreadsheet

I have created this to show how the yield reserve will be affected by all the different parts of the business. This is the snapshot as of Feb 3, 2022:

You can duplicate this sheet, and play around with the scenarios, namely: what if LUNA price drops? What if borrow interest increases?

What if the Yield Reserve is depleted?

This is a question many asked. Some wonder if Anchor/Terra will collapse once the yield reserve is depleted.

There is nothing much to worry about. They designed for it:

If real yield < Anchor Rate, the yield shortfall is drawn down from the yield reserve until it is depleted. Additionally, ANC incentives to borrowers increase by 50% every week until the real yield converges to the Anchor Rate.

One thing I didn’t point out earlier is that borrowers have an incentive to borrow – they earn ANC token! So when the reserve is depleted, they earn even more ANC. There will be more borrowers, because they can potentially earn more than the interest paid.

Even the CEO said:

the yield reserve is designed that way (can be depleted), and when that happens, yields will drop to 15%, which is still be far the highest return for a stablecoin.

The risks

So, it seems like everything is sound. There are only some risks to discuss.

UST can become unpegged. This is quite unlikely due to the algorithmic nature of this stablecoin, which uses a burn and mint way to maintain the peg. I will not discuss the details, but in short, if UST becomes $0.80, then LUNA will decrease in price, and push up UST price, vice versa.

Deposit rate will decrease. Yes, this can happen. If so, simply move away if you have better opportunities!

Whole of Terra might spiral to death? Anything is possible, but the ecosystem is strong.