Why Micro Strategy is so bullish on bitcoin

MicroStrategy’s relentless accumulation of Bitcoin has raised eyebrows across both the corporate and crypto worlds. What’s behind their conviction? In a nutshell, it boils down to Bitcoin’s unmatched “useful lifespan,” a bold 2024 projection, and an innovative treasury strategy that spawns a whole menu of Bitcoin-based securities.

1. Bitcoin’s Useful Lifespan vs. Physical & Financial Assets

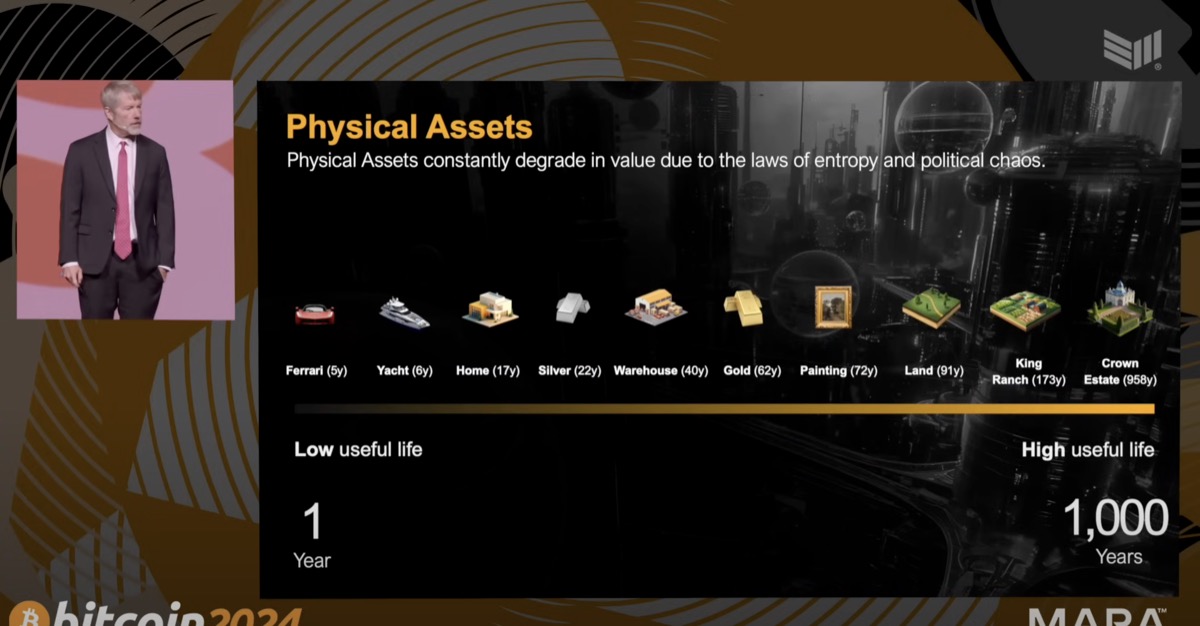

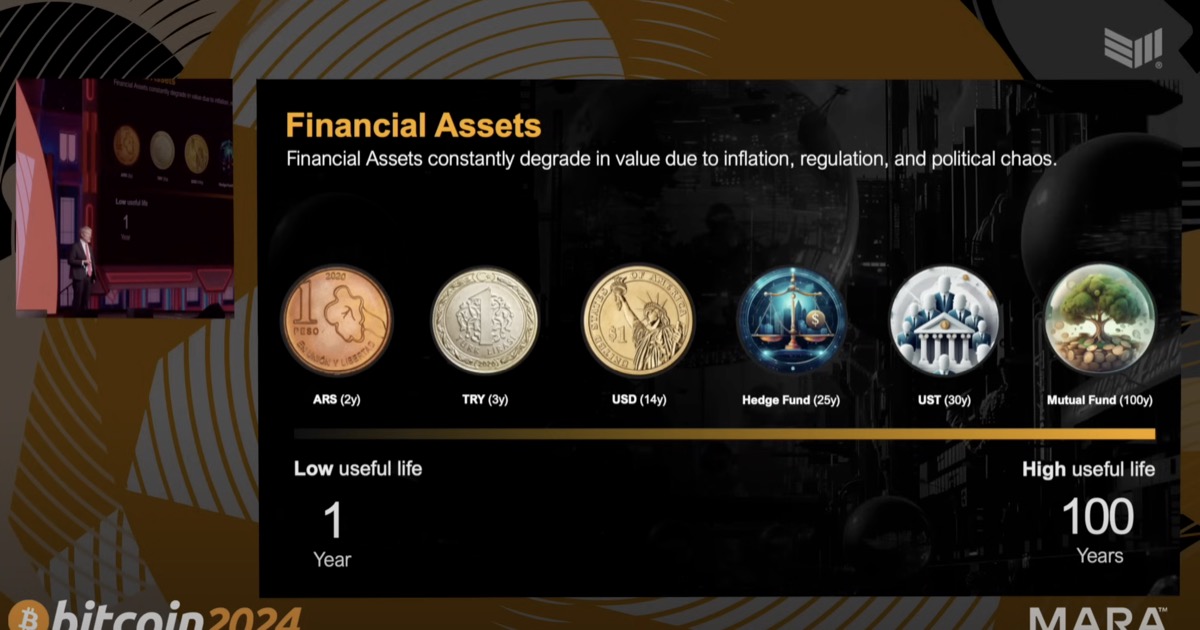

One of Michael Saylor’s favorite metaphors is “useful life.” Every asset has a horizon over which it reliably preserves value:

-

Physical Assets (cars, homes, gold, real estate) degrade over time—wear & tear, entropy, political risk.

Ferrari (5y) → Yacht (6y) → Home (17y) … Crown Estate (958y) -

Traditional Financial Assets (fiat, bonds, mutual funds) erode via inflation, regulation, credit cycles.

ARS (2y) → TRY (3y) → USD (14y) … Mutual Fund (100y) -

Bitcoin stands apart. Immutable code—backed by decades-long cryptography roadmaps—gives it a multi-millennial shelf life. Saylor quips that Bitcoin belongs on the “saving” axis that stretches to 100,000 years and beyond.

Bottom line: Bitcoin’s self-enforcing monetary policy and decentralized security make it the ultimate “capital preservation” asset—far beyond anything banks, bonds or bricks can offer.

2. Saylor’s 2024 Projection

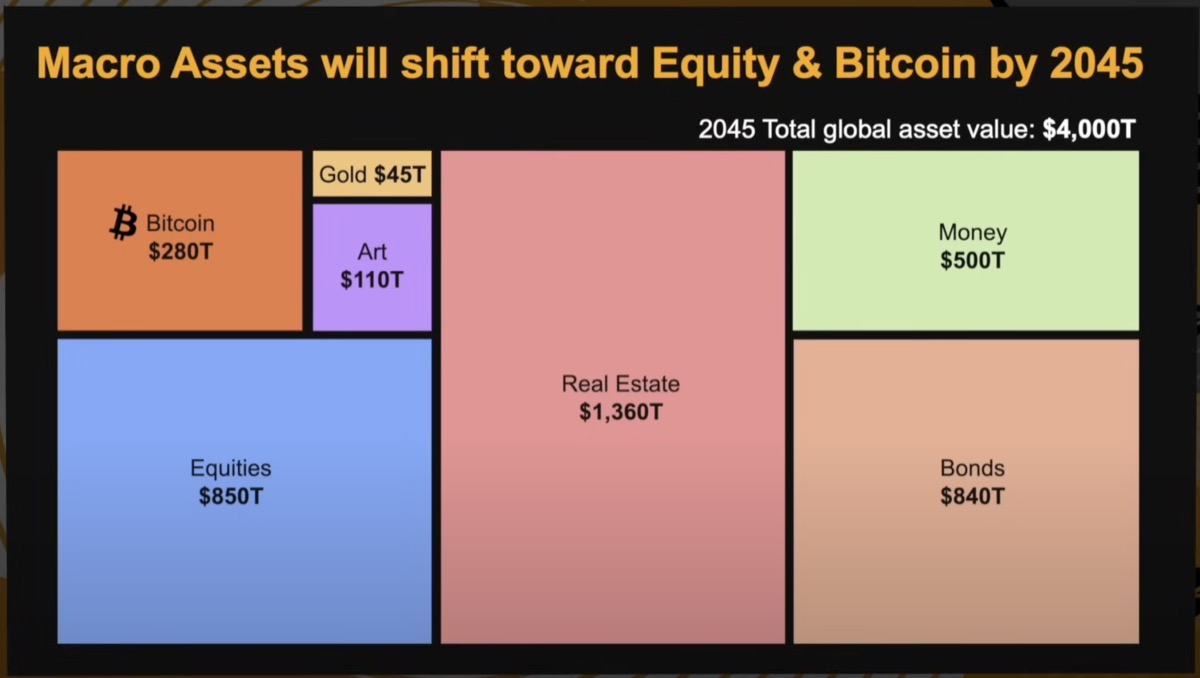

In early 2024, MicroStrategy laid out a grand vision:

- Bitcoin as a $2+ trillion asset class—not a niche “crypto toy,” but on par with gold, art, real estate.

- 2045 macro shift—they forecast a $4 trillion global pie, with Bitcoin claiming $280 trillion (7%) alongside equities, real estate and bonds.

- Near-term upside—with only ~19 million BTC ever to exist, continued corporate and sovereign adoption should drive scarcity, price discovery and institutional products.

By 2045: Real Estate $1,360T | Equities $850T | Bonds $840T | Money $500T | Bitcoin $280T | Art $110T | Gold $45T

Key takeaway: MicroStrategy sees Bitcoin not as a fad but as the next great reserve asset, destined to sit alongside—or even displace—traditional stores of wealth.

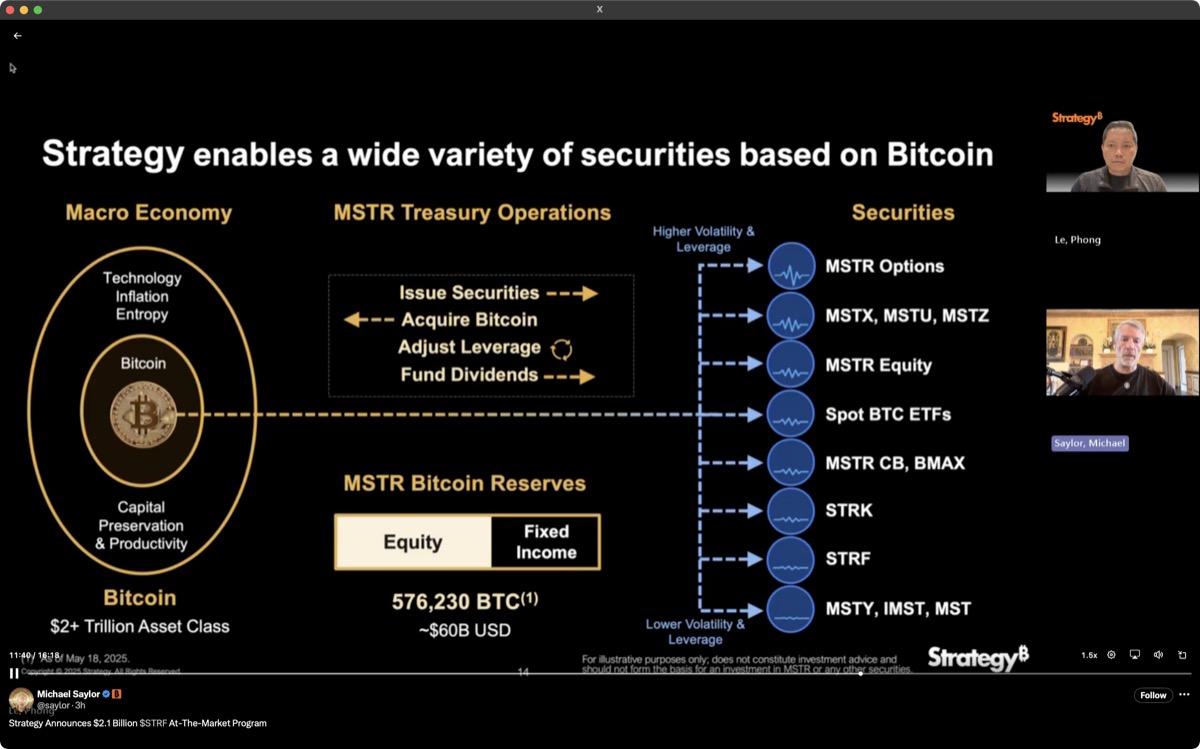

3. MicroStrategy’s Bitcoin-Powered Treasury Strategy

Rather than hoard cash, MicroStrategy has turned its treasury function into a Bitcoin-factory—and a launchpad for new securities:

- Issue & Acquire

- Raise capital via equity, convertible notes and bonds → buy more BTC

- Current holdings: 576,230 BTC (~$60 billion USD)

- Leverage & Layer

- Dynamically adjust leverage against volatility

- Fund dividends or buybacks denominated in Bitcoin

- Spawn Bitcoin-Based Products

- MSTR Options: leverage on MicroStrategy’s BTC exposure

- Convertible Bonds & BMAX: notes tied to Bitcoin price

- STRF / STRK ATM Programs: systematic equity-to-BTC flows

- Spot BTC ETFs: future institution-grade, custody-backed funds

“Issue → Acquire → Adjust → Dividend” is the new corporate playbook.

Why it matters: By embedding Bitcoin at every layer—from their balance sheet to financial instruments—MicroStrategy turns one of the world’s largest BTC treasuries into a self-reinforcing engine for institutional adoption.

In Summary

MicroStrategy’s bullishness on Bitcoin isn’t hype—it’s a deliberate, multi-decade strategy built on:

- Unrivaled longevity (thousands vs. hundreds of years)

- Convincing long-term forecasts (trillions on the horizon)

- An innovative corporate treasury that issues, acquires and packages BTC into a diverse suite of securities

Whether you’re a corporate treasurer or a retail investor, the MSTR playbook makes one thing clear: Bitcoin isn’t just digital gold—it’s the next chapter in corporate finance.