How MicroStrategy works

Let’s unpack MicroStrategy’s big Bitcoin bet 🚀 .

What is MSTR?

MSTR is the stock ticker for a company called MicroStrategy. For ages, they’ve been a regular software company, making tools that help big businesses understand their data. Pretty standard stuff.

Here’s the twist! A few years back, MicroStrategy decided cash in the bank was kinda boring and losing value. So, they started taking their company’s spare cash – and then some – and buying Bitcoin. Like, a lot of Bitcoin.

They basically said, “We think Bitcoin is a better place to keep our company’s savings for the long haul.” Now, they’re one of the biggest corporate Bitcoin holders out there!

How Do They Get All That Bitcoin?

It’s not just pocket change! They use a mix of:

- Their software business profits: Money from selling software goes into buying Bitcoin.

- Selling their own stock (MSTR): They sell bits of their company to get cash for more Bitcoin.

- Taking out loans: Yep, they borrow money to stack even more sats (that’s crypto-speak for small bits of Bitcoin).

Their Investment Strategy

If you’re curious about Bitcoin but not ready to buy it directly, some people look at MSTR stock. Because MicroStrategy owns so much Bitcoin, their stock price often moves up and down with Bitcoin’s price.

Think of it like this: investing in MSTR is a bit like betting on Bitcoin, but you’re buying shares in a company that’s betting big on Bitcoin. It has its own twists because it’s still a software company that also takes on debt.

Other than that, they have other financial products that “generate yields” such as strike and strife.

The Bottom Line

MicroStrategy (MSTR) = Software company that’s gone MASSIVELY into Bitcoin. Their stock is now a big topic for anyone interested in how companies are jumping into crypto.

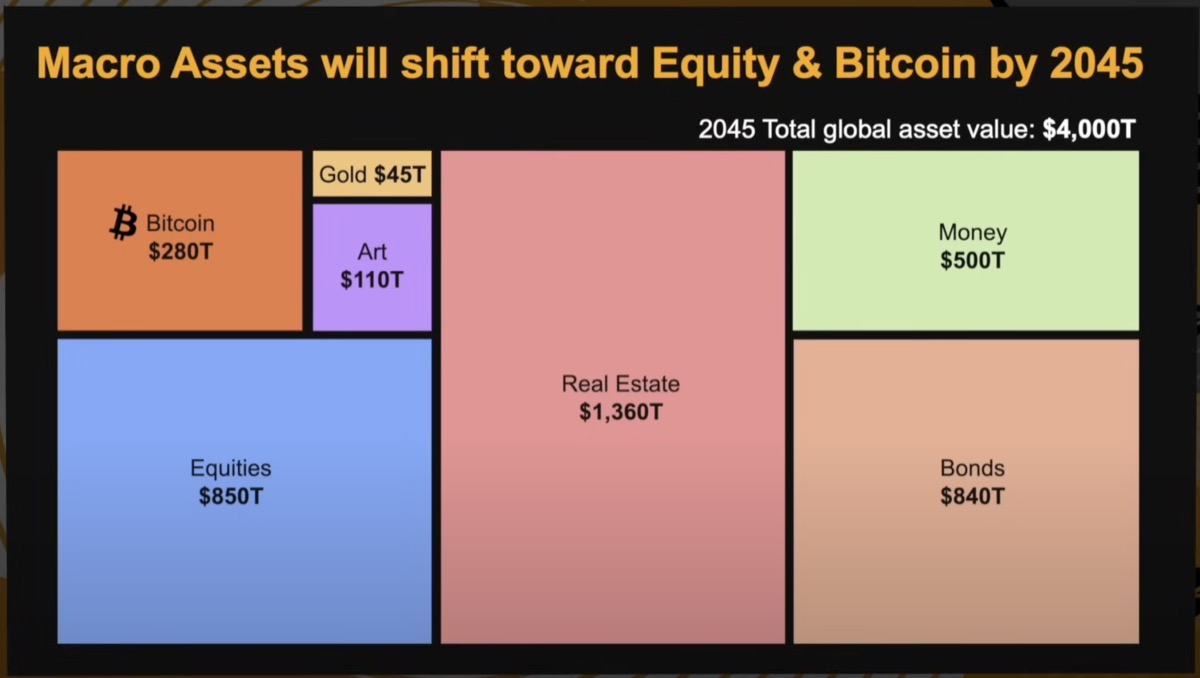

Still not convinced? Then hear it directly from Michael Saylor’s Bitcoin 2024 Keynote Speech: