What is DeFi lending's folding strategy?

Folding strategy is repeatedly lending and borrowing on a platform. It is a trick to maximize your dollar.

How it works?

Let’s say you have 1,000 USDC and you lend it out on a lending platform.

If the Loan-to-Value (LTV) is 70%, then you are able to borrow 700 USDC. Your initial 1,000 USDC will be used as collateral.

With the 700 USDC, you lend it out again.

You will be able to borrow 70% of 700 = 490 USDC.

You can keep on repeating this, loop it, aka folding, and get a smaller and smaller loan.

Why would you do it?

When the supply yield > yield borrow.

Borrow interest rate is usually higher. I hope that is obvious.

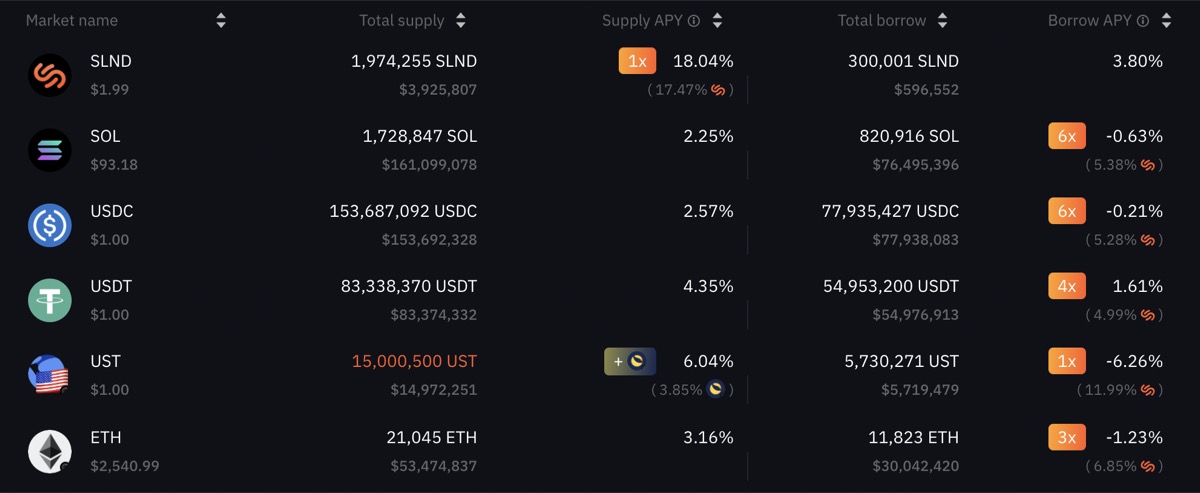

But often, a project will emit bonus tokens as an incentive. This will tilt the yields. The screenshot below is from Solend, where it is emitting SNLD, their own token.

Supply interest higher than borrow interest!

Supply interest higher than borrow interest!

While it looks attractive, the price of such emission tokens usually drop over time, hence the APY can be misleading.

What does it cost?

It costs gas every time. So if gas fee is high, there will be a point where it doesn’t make sense. Eg. you won’t want to pay $50 ETH gas fee for a $200 borrow.

🔗 Check out what is gas and how to calculate it.

What are the risks of multiple foldings?

There is actually no change to the “health factor” or to the liquidation limit when you do multiple folding. If you fold 1 time; supply 1,000 USDC and borrow 700 USDC, you will be at 70% borrow limit.

If you fold 2 times; supply 700 USDC and borrow 490 USDC -> In total you would have supplied 1,700 USD and borrowed 1,190 USDC, that is still at 70% borrow limit!

Single Asset vs Cross Asset Folding

If you supply ETH and borrow ETH, this is single asset folding, and is more predictable. Eg. If ETH drops, then what you borrow also drops in value.

In Cross Asset folding, you borrow a different token. Generally more risks as the pair (or more) can diverge.