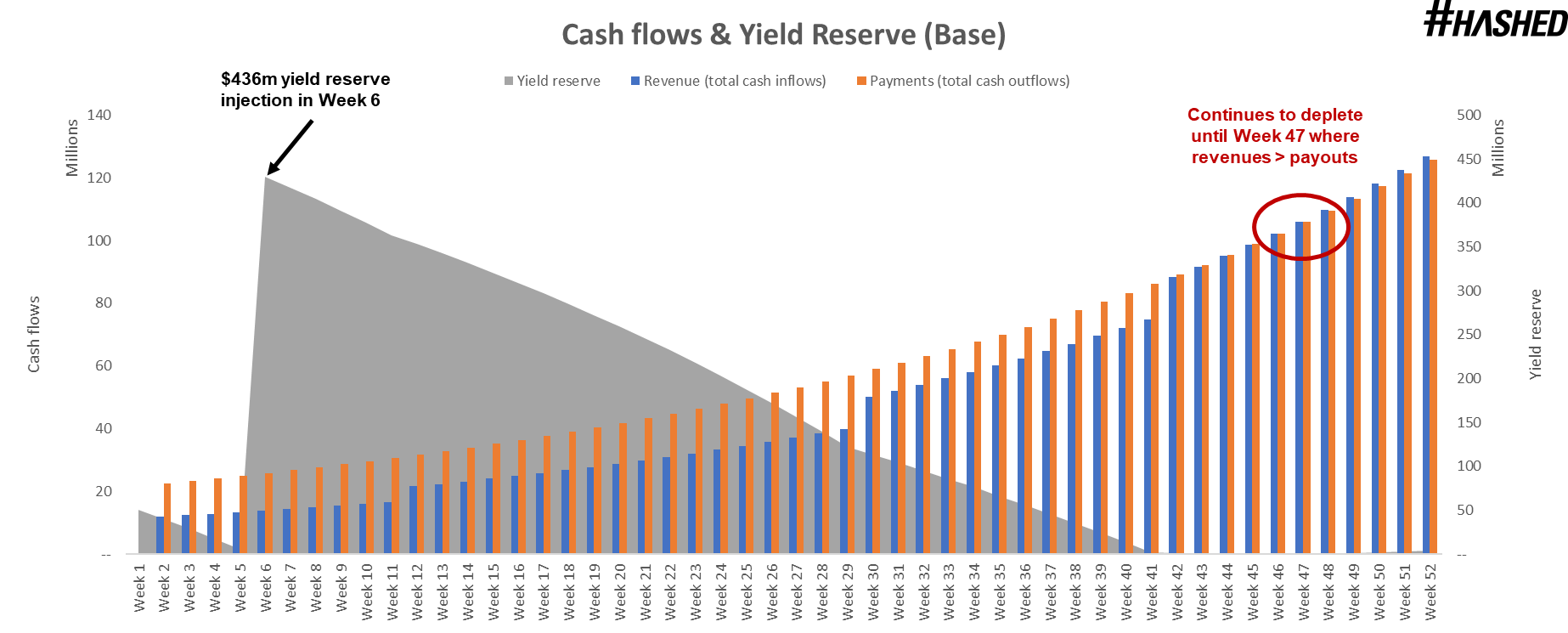

Adding $450M to Anchor Yield Reserve

In the last post, I introduced Anchor Protocol and their savings interest rate of 20%! A key discussion is on the Yield Reserve, which will be delepted in around 10 days at the current pace.

But fear not.

As expected, they will capitalise the reserve with $450,000,000, which is estimated to last 1 more year! Which means 20% savings interest for 9 more months 🎉

They expect to delepte, once again, on week 41 of 2022, and then to “become profitable” on week 47.

Why continue to fund?

They continue to fund Anchor and reserve because they want to keep the interest rate at 20%, instead of letting it fall to ~10% (market money rate). While ~10% is still high, that will be unattractive when compared to other stablecoins (USDC, USDT) which can achieve the same.

So they must keep their interest rate at 20% to attract more users.

They treat this $450M as marketing budget.

Who pays?

Good question.

The money will come from Luna Foundation Guard (LFG), which is a newly-created entity from Terraform Labs (TFL). As Terra CEO said:

The reason we’ve set up LFG is to decentralize decision making processes in the Terra ecosystem, and having multiple directors (all building on the Terra ecosystem) make the decision instead of one person

How they pay?

LFG has 50M LUNA. At current LUNA price of $50, that is $2,500M warchest!

But always remember, tokens are created out of thin air, and valuation is subjective.

So in a way they are burning LUNA and minting UST to fund the yield reserve.

For full details, read the proposal.