How to stake Solana

Crypto.com is a great exchange with many high yields when you deposit tokens with them. But for depositing Solana, the return is a mere 3%. In this post, I will show you how to stake Solana via Solflare, and achieve a 6.67% yield. To do that, you will have to move from Crypto.com (custodian) to your own wallet (non-custodian).

You can also watch this youtube video and refer to the slides.

Step 1: Buy SOL

You can buy Solana token (SOL) on crypto exchanges. I recommend starting with Crypto.com App.

Step 2: Transfer to Solflare wallet

All tokens that you have bought on crypto exchanges are custodian. That means they are being held under the exchange wallet.

You will need to transfer them to your own wallet. When you have done that, you would have truly own the coins.

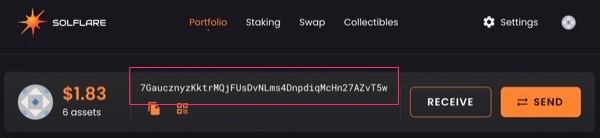

Solflare is a Solana supported wallet. Create a new wallet if you don’t have one. You will find your wallet address (eg. 7GaucznyzKktrMQjFUsDvNLms4DnpdiqMcHn27AZvT5w) at the top like this:

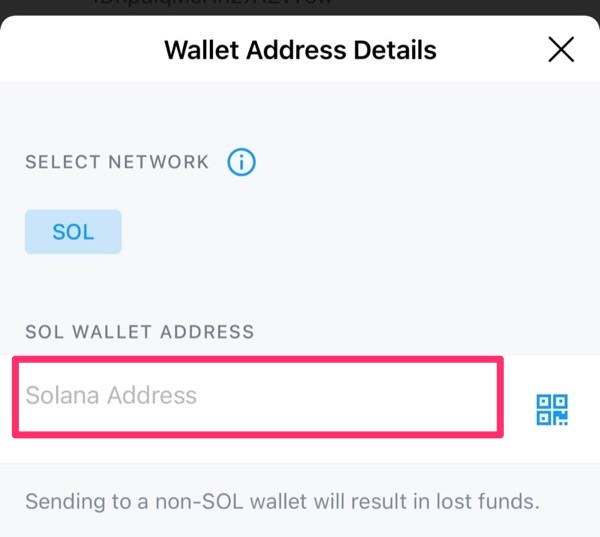

Finally, you will have to transfer/withdraw SOL from your crypto exchange to the Solana wallet address. It is IMPORTANT that you send to the correct network – Solana (aka SOL or SPL Token Program).

Adding the wallet address on Crypto.com

Adding the wallet address on Crypto.com

There might be transaction fee (aka gas fee) depending on the exchange you use. For Crypto.com, there is a withdrawal fee of 0.005 SOL (~$1).

Step 3: Stake on Solflare

After a while (up to minutes), the transaction will be updated on the Solana network, and your wallet will be updated to show the SOL you have received.

Staking can be done on Solflare easily. There are 2 options:

- Native staking

- Liquid staking (higher risk, higher yield)

Native staking is doing proof-of-stake on the Solana blockchain. You will have to choose a validator to stake on. A validator is a computer that is maintaining the blockchain. You can find all the validators & their commission fee on solanabeach.io, and also check out their recent performance on stakeview.app.

On Solflare, go to Native Staking > Create Account > Enter amount & select validator > Stake. There will also be a gas fee.

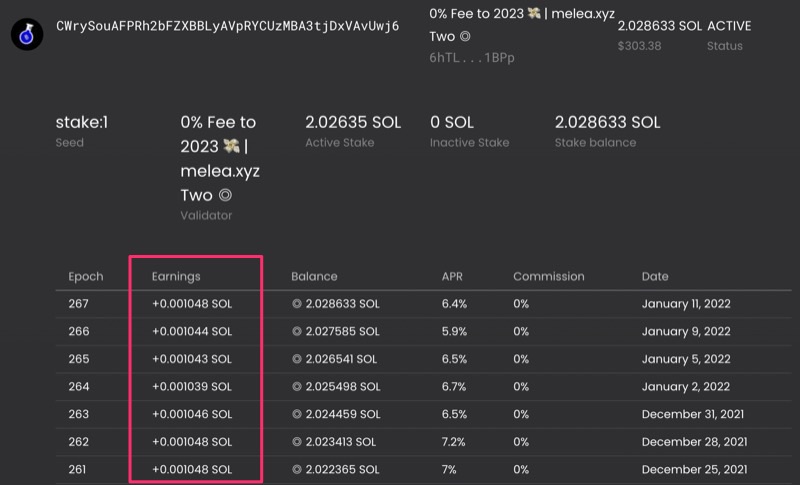

Rewards will be distributed around every 3 days, and compounded.

Native staking is comparatively less risky than liquid staking, because it is simply staking SOL with validator who are doing proof-of-stake for the blockchain, which is a legit operation to keep the blockchain running.

Liquid staking is outsourcing to Marinade, which is a DeFi with liquidity pools etc, which can help you increase the yields further.

There are a few components in Marinade, more choices to made, with higher risks – therefore more yields. To understand fully, check our this post.