Liquid Staking on Marinade

We have covered how you can stake Solana natively in the last post. In this post, we will cover liquid staking, which in essence is exchanging Solana for a derivative token that grows in value as it earns staking rewards.

Who is Marinade?

Marinade is a DeFi that provides liquid staking in the Solana ecosystem.

In terms of security, they have been audited by KudelskiSecurity and Ackee Blockchain. This is part of the audit conclusion:

The code shows clear signs of rapid development where speed stakes precedence over best coding practices. Combined with relying on other software that is still under development makes introducing bugs into the code base inevitable. We believe the project lacks technical leadership with clear rules and guidelines for development…

While it isn’t a good conclusion, the takeaway is that they are open to audits early.

As per all DeFi, there are risks. But they look okay, with support from Solana Foundation, so I am willing to take the risk.

Swap SOL for mSOL

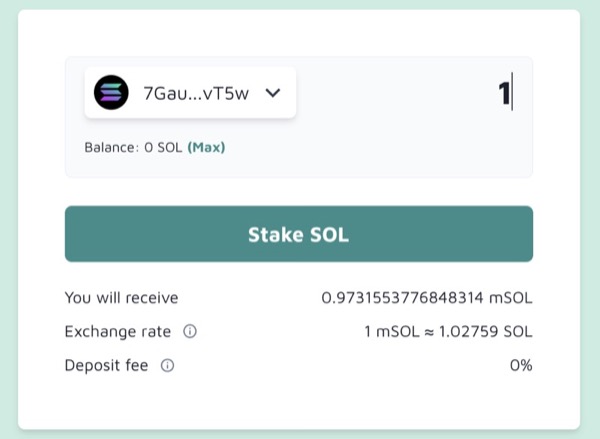

Go to Marinade app > Connect your wallet > Stake > Enter number of SOL.

In the screenshot above, I am swapping 1 SOL for 0.973 mSOL. It is less than 1 SOL, because mSOL price will increase over time, as they will accumulate the Solana staking rewards.

The 1 Solana that I deposited into Marinade will be staked natively. Marinade will decide the validators to stake with, so I don’t have to make a decision. Every epoch (~2 days), the validators will reward Marinade (~6.67% APY). I won’t get the SOL, but the mSOL that I hold will increase in value.

Swap back

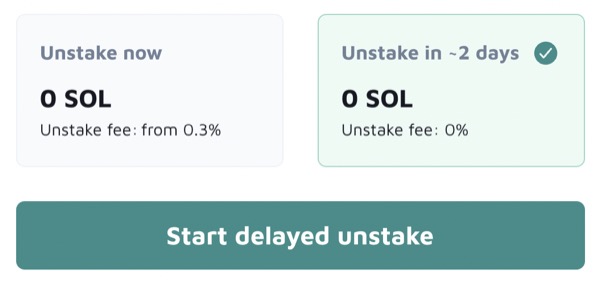

To exchange back to SOL, I will have to Unstake, which is the reverse process. When I exchange mSOL for SOL, I should have more than 1 SOL.

Take note of the unstake fee. If you can wait for 1 epoch (~2 days), then it is free. If not, you will incur 0.3% to 3% fee, depending on the total liquidity available in the Marinade pool.

How to get higher yields?

If you have instead staked natively, your SOL would have been locked up, and you have nothing else to play with.

But in liquid staking, you have a derivative SOL – mSOL – and you can do more with it.

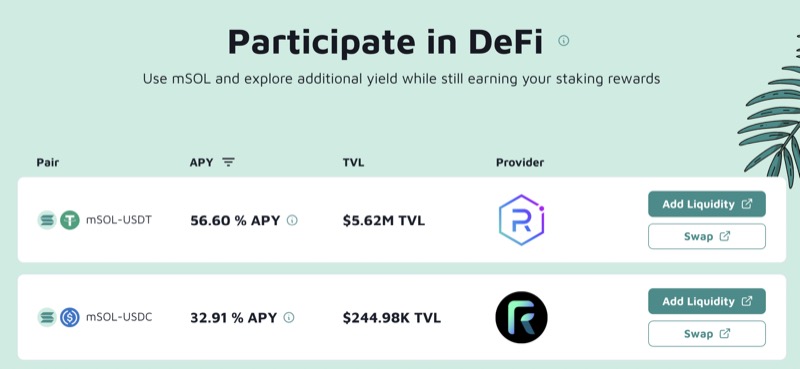

Firstly, you can provide mSOL to a Liquidity Pool (LP) eg. mSOL-USDT, and earn fees when people use the pool to swap.

Look! The crazy high APY!

Look! The crazy high APY!

Then you can further stake the LP token for more rewards.

These will be covered in the next post.