What is Liquid Staking

Liquid staking is a derivative form of staking. Instead of staking eg. Solana tokens (SOL), you exchange your SOL with a derivative token. Let’s call this imaginary derivative dSOL.

Why exchange for a derivative?

If you have simply staked SOL, then there is nothing else you can do.

But if you have instead exchanged for dSOL, then you can achieve higher yields by staking the dSOL. Or earn trading fees from a dSOL liquidity pool. Or you can lend it out on a lending platform. There are more DeFi plays with a derivative token.

Liquid Staking Providers

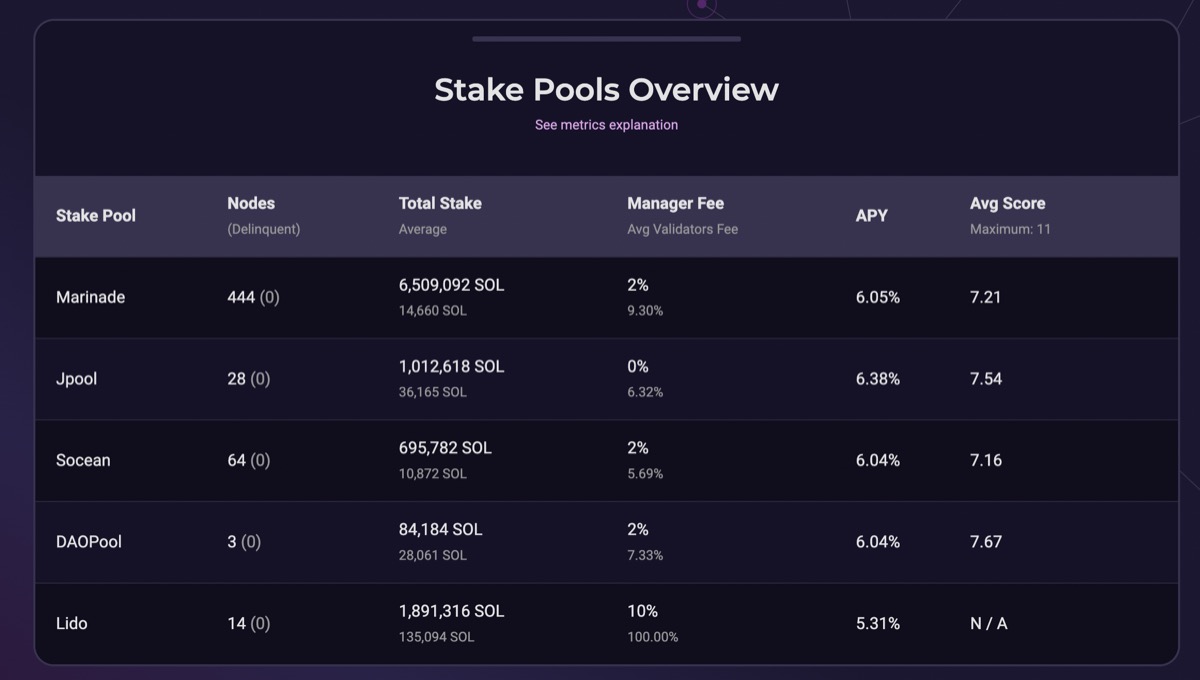

There are many providers. I covered Marinade finance previously. They are the largest and their manager fee is only 2%.

Lido is the 2nd largest, but the fee is much higher at 10%. Lido also provides liquid staking for Ethereum and others.

The risks with derivative

Derivative is issued by a 3rd party, therefore another layer of trust.

If the liquid staking provider is new, it is better that you research to make sure it is legit. Ultimately, you are handling your tokens to them, and they are simply issuing you a derivative.

They could also be smart contract bugs.

How does it work?

The exchange rate between SOL and dSOL will be different. For example 1 dSOL = 1.2 SOL.

That is because the staking rewards from the provider is added to the pool, therefore increasing it’s value.

Let’s say you exchanged 1.2 SOL for 1 dSOL.

After a year, when you exchange it back, 1 dSOL will worth more, eg. 1.3 SOL.